The Swedish Tax Agency’s New Approach to Intra-Group Financial Guarantees

.jpg) ‹ Back to the articles

‹ Back to the articles

The Swedish Tax Agency's two previous positions on financial guarantees are being reconsidered in order to better align with international guidelines. We explain what the new position means for multinational groups and what is important to consider when engaging in financial guarantees transactions.

We have previously written in Tax Matters about the OECD’s final Transfer Pricing Guidelines on Financial Transactions. While their primary focus area was loans and the appropriate interest on those, the guidelines also covered Financial Guarantees. The arm’s length pricing of financial guarantees is an area where the Swedish Tax Agency has previously lost numerous court cases. As a result of these court cases, the Swedish Tax Agency issued two position papers which allowed, in many cases, the possibility for Swedish based multinational companies to issue financial guarantees without the need to charge for those. These previous position papers issued by the Swedish Tax Agency are now overturned by a new position paper, significantly expanding the situations where charges are deemed necessary for financial guarantees issued among group companies.

The Swedish Tax Agency changes its approach to financial guarantees

On April 14th, the Swedish Tax Agency presented its revised guidance on Financial Guarantees following consultation of the new OECD guidelines on the subject matter. This now replaces its position papers from 15 August 2007 regarding:

- The Arm’s Length Pricing of financial guarantees granted by Swedish companies.

- The deductibility of costs with intra-group financial guarantees.

In the past, the Swedish Tax Agency considered that companies should not charge for the financial guarantees they granted to group members, unless they incurred various expenses for this purpose, or if issuing the guarantee has led to any reduction of revenues.

When analysing financial transactions (including guarantees) the analysis shall be performed in two steps:

- A review of the facts and circumstances of the transaction..

- The appropriate arm’s length compensation.

Compensation can only be relevant for explicit guarantees since it is only then that the guarantor bears a risk. However, compensation is not always necessary for all types of explicit guarantees.

Five important questions to consider

Reflect on the following if you wish to grant or receive a financial guarantee from an entity within your group in order to benefit from more favourable interest rates for a bank loan.

1. Is this transaction creating a benefit?

Generally, by its better credit rating or its assets, the guarantor helps the borrower obtain better lending terms – a lower interest rate or access to a loan of a higher amount. However, if these better lending terms are no different than those which the lender would already have received as a result of being part of the group, then it can be considered that the financial guarantee brings no added value. The same could be if the cost of a guaranteed loan, together with the cost of the guarantee used, is equal or higher to the cost of an unguaranteed loan.

2. Is the guarantor able to provide the financial guarantee?

By virtue of a better credit rating or of the pool of assets which would make an entity suitable to offer a financial guarantee, a guarantor could assist the lender in obtaining better credit terms (as discussed above).

3. What does this transaction offer to an entity that is part of a group?

When dealing with financial guarantees, you must take into account the fact that being part of a group might already allow you to receive better lending terms. Obtaining a guarantee from a group member might enhance those terms even further, but this can vary from case to case. Moreover, only an explicit guarantee would mean that the guarantor assumes a risk and would lead the bank to provide better conditions.

4. What should be the price for my financial guarantee?

The general rule is that prices for intra-group transactions should be similar to those paid by independent companies in similar situations. However, the OECD provides a few potential ways to determine an arm’s length price:

- Actual comparison with the price practiced in similar agreements between unrelated entities. This can however be hindered by lack of public information, or by differences in terms for which adjustments cannot be made;

- Determination of the maximum value of the guarantee fee as being equal to the benefit that the financial guarantee brings to the lender. This sets the maximum allowable level of compensation, as no independent entity would pay more for the guarantee than the reduction in interest rate that it would secure;

- Replacement cost for the guarantor – what could the guarantor gain by using his potential to grant a financial guarantee for another purpose?

- Estimation of potential loss for the guarantor if the lender becomes unable to pay the borrowing bank;

- Determination of the cost of capital that the lender should receive in order to achieve a similar reduction in interest rates to that resulting from the financial guarantee.

5. The Swedish Tax Agency’s previous recommendations were followed when the financial guarantee was issued or received – can that lead to tax adjustments now that the Swedish Tax Agency changed its interpretation?

No, this review of their approach to financial guarantees only applies to future transactions. However, for past transactions, taxpayers will be judged using the most favourable approach from these two.

Comments

The past guidance from the Swedish Tax Agency was based on the outcome of numerous assessments made by the Swedish Tax Agency, which all but one were overturned by the Administrative appeal court in favour of the taxpayers. Therefore, the various decisions of the Administrative appeal court affected the previous two positions from 2007, instead of taking into account the Tax Agency's actions in audits where they tried to revise the taxable income upwards for the taxpayers who had not paid guarantee fees. Consequently, the position papers earlier issued by the Swedish Tax Agency deviated from the international norm commonly being applied by foreign Tax Agencies, foreign courts and the general practice among advisors and companies alike. Therefore, the new guidance from the Tax Agency was awaited and not surprisingly. However, for companies, particularly for Swedish multinationals, with one or more explicit guarantees issued to foreign group companies it becomes necessary to review if, based on the new guidance, the facts and circumstances require that a charge is necessary and, if so, what is the appropriate arm’s length price for such a guarantee.

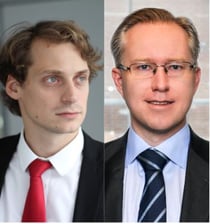

Adrian-Daniel Nistor & Pär Magnus Wiséen

Pär Magnus Wiséen och Adrian-Daniel Nistor arbetar som skatterådgivare på PwC:s kontor i Stockholm respektive Jönköping med internprissättningsfrågor.

Pär Magnus: 010-213 32 95

paer.magnus.wiseen@pwc.com

Adrian-Daniel: 073-860 21 46,

adrian-daniel.nistor@pwc.com

Leave a comment