Tax-free benefits in this spring’s salary negotiations

‹ Back to the articles

‹ Back to the articles

It is beginning to be time to negotiate salaries for 2016. In this context, it can be good to also discuss benefits incurring tax advantages. This applies to both employees and owners. Offering benefits can, of course, help in discussing salary levels.

It is beginning to be time to negotiate salaries for 2016. In this context, it can be good to also discuss benefits incurring tax advantages. This applies to both employees and owners. Offering benefits can, of course, help in discussing salary levels.

In addition, the share dividend season is upon us in conjunction with the spring’s annual shareholders meetings. It could be a good idea for owners of closely held companies to spend a little extra time on this topic this year. Next year both tax on low taxed dividends can be increased, and the amount can also be limited. Read more about this in my previous articles regarding the current 3:12-committee.

Benefits for both owners and employees

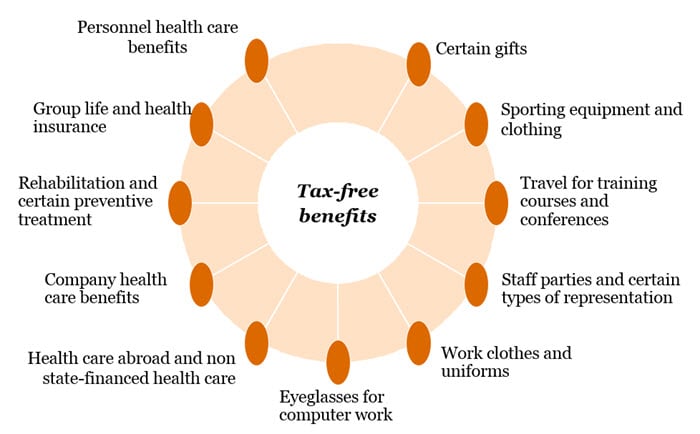

The most interesting of benefits are listed in the circle below. In addition to these, there are benefits which are taxed on the basis of a standard rate. These can sometimes be of interest but I won’t address these in this article. Company cars comprise an increasingly less attractive benefit, unless one drives a great deal privately or if you like to always have a new car or like to drive an environmental car. The definition of the latter tends, however, to change far too often, which impacts the second-hand value of the vehicles.

The red thread in the various tax-free benefits is health and well-being. Better health benefits both the employee and the company. The more fun and enjoyable the work environment, the better the work efforts, in general. Here there is the possibility of killing two birds with one stone. Private health insurance costing around SEK 5,000 per year and per employee, or less, is often worth gold when it comes to ensuring that the employee can quickly obtain a diagnosis, solve the medical problem in question and, then, come back to work.

The backside of the coin can be that such benefits, once being introduced, are difficult to take away when circumstances change, which they always do. Salary exchange, instead of salary, can result in lower pensions and lower social security benefits. It is important to consider all of the aspects regarding a certain form of compensation and reconcile these with your tax advisor.

3 tips about benefits

Mobile telephone. A tax-free benefit arises when you use the mobile telephone for private calls at the ”flat rate” subscription price. The requirement is that the mobile is of significant importance in executing your work. Who can work today without a mobile telephone?

Broadband. Tax-free benefit if this is a work tool. This can be difficult to evidence if there is no private subscription. When it comes to fiber, it is not possible to have the company assume private costs. This is seen as an improvement of a privately-owned residence.

Laser eye surgery. If undertaken by private healthcare providers, this is a tax-free benefit for the employee. However, the company cannot deduct these costs. It is also OK to deduct the cost from the employee’s salary before tax which does not result in any benefits for the employee.

PwC

PwC Sverige är marknadsledande inom revision och rådgivning med 2 700 medarbetare runt om i landet – vi finns där du finns! Vårt syfte är att skapa förtroende i samhället och lösa viktiga problem och våra värderingar genomsyrar allt vi gör.

Leave a comment